Disrespecting the Middle Class With Taxation Policy

What Monkeys Know That Some Middle Class Folks Fail to Grasp

Welcome to From Insults to Respect. Very recently, the US government passed a bill that provides a major overhaul of our taxation policy. Since the bill was signed into law, some of my friends have begun to ask me what I think of it. In response, I first tell them about a psychological study.

The Study

In the study, primatologists Sarah F. Brosnan and Frans B.M. de Waal trained capuchin monkeys to perform a certain task for which they receive, as a reward, cucumber slices. The monkeys performed the task just fine until they were permitted to see another monkey being rewarded with grapes, a higher-value payment. Suddenly many of the cucumber-receivers refused the cucumber, sometimes even throwing those measly, unfair cucumber payments at the experimenter who was giving out the reward. In a delightful YouTube video that you can access for free HERE, you can witness this for yourself. Behavioral economists call the behavioral characteristic exhibited by the monkeys “inequity aversion”—the tendency to turn down a perfectly good offer if others are getting a better deal.

In the study, primatologists Sarah F. Brosnan and Frans B.M. de Waal trained capuchin monkeys to perform a certain task for which they receive, as a reward, cucumber slices. The monkeys performed the task just fine until they were permitted to see another monkey being rewarded with grapes, a higher-value payment. Suddenly many of the cucumber-receivers refused the cucumber, sometimes even throwing those measly, unfair cucumber payments at the experimenter who was giving out the reward. In a delightful YouTube video that you can access for free HERE, you can witness this for yourself. Behavioral economists call the behavioral characteristic exhibited by the monkeys “inequity aversion”—the tendency to turn down a perfectly good offer if others are getting a better deal.

Do Capuchin Monkeys Comprehend Something Middle Class Supporters of the Tax Bill Fail to Grasp?

The new tax policy would deliver more than 50 percent of its benefits to the top 1 percent, according to an analysis by the nonpartisan Tax Policy Center (TPC). Meanwhile, America’s poorest families would get a tax benefit less than 1 percent growth in after-tax income. A middle-class household with $67,000 of income will receive an average tax cut of $930 next year, while a fairly wealthy family with $348,000 of income will get an average tax cut of $7,640. Very wealthy families will get a far larger break. One in five Americans making the median household income would actually see a tax hike.

The new tax policy would deliver more than 50 percent of its benefits to the top 1 percent, according to an analysis by the nonpartisan Tax Policy Center (TPC). Meanwhile, America’s poorest families would get a tax benefit less than 1 percent growth in after-tax income. A middle-class household with $67,000 of income will receive an average tax cut of $930 next year, while a fairly wealthy family with $348,000 of income will get an average tax cut of $7,640. Very wealthy families will get a far larger break. One in five Americans making the median household income would actually see a tax hike.

The new tax policy is estimated to increase the national debt by over a trillion dollars, which eventually will have to be paid, plus interest. That interest will be paid to financial institutions that benefit the rich. The tax breaks for the rich in this bill were written in a way that make them permanent, whereas the parts of the bill that will give the slight benefits to a majority of middle income people are temporary.

Despite these facts, there are some middle class voters who are actually supporters of the new tax policy. What are they thinking? Well, the most common defense comes down to the old trickle down theory. So, let’s take a look at this.

Trickle-down Economics

Trickle-down economics, also referred to as trickle-down theory, is an economic theory that advocates reducing taxes on businesses and the wealthy in society as a means to stimulate business investment in the short term and benefit society at large in the long term. For those who want to see how much support there is for this theory, I suggest placing the following words into your search engine–Trickle-down theory, evidence for support. By doing so, you will find that the theory has been a dismal failure. For a brief summary of these findings, I recommend Wikipedia’s entry on this topic. Here are some quotes:

Trickle-down economics, also referred to as trickle-down theory, is an economic theory that advocates reducing taxes on businesses and the wealthy in society as a means to stimulate business investment in the short term and benefit society at large in the long term. For those who want to see how much support there is for this theory, I suggest placing the following words into your search engine–Trickle-down theory, evidence for support. By doing so, you will find that the theory has been a dismal failure. For a brief summary of these findings, I recommend Wikipedia’s entry on this topic. Here are some quotes:

The term trickle-down originated as a joke by humorist Will Rogers and today is often used to criticize economic policies which favor the wealthy or privileged, while being framed as good for the average citizen. In recent history, it has been used by critics of supply-side economic policies…

Multiple studies have found a correlation between trickle-down economics and reduced growth.[6][7][8][9]

A 2012 study by the Tax Justice Network indicates that wealth of the super-rich does not trickle down to improve the economy, but tends to be amassed and sheltered in tax havens with a negative effect on the tax bases of the home economy.[9]

A 2015 paper by researchers for the International Monetary Fund argues that there is no trickle-down effect as the rich get richer: [I]f the income share of the top 20 percent (the rich) increases, then GDP growth actually declines over the medium term, suggesting that the benefits do not trickle down. In contrast, an increase in the income share of the bottom 20 percent (the poor) is associated with higher GDP growth.[6]

Rather Than Hoping That the Middle Class Might Indirectly Benefit From Giving a Larger Tax Break to The Rich, Why Not Directly Give The Middle Class The Larger Tax Break?

Those who supported the bill claimed that it was designed to help the middle class. Two ways our heavily lobbied representatives could, if it really wanted to help the middle class, is to increase the Earned Income Tax Credit (EITC), and to increase the minimum wage to $15 an hour.

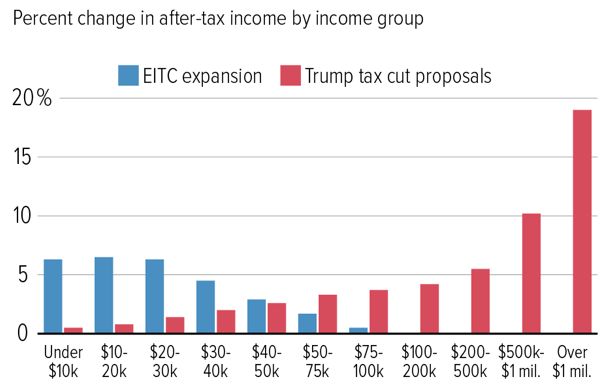

Representative Ro Khanna has proposed a $1 trillion expansion to the EITC. The plan would give about 50 million households an average tax benefit of roughly $3,000 per year; Americans earning more than $100,000 would get no tax benefit. In the graph below, the nonpartisan Center for Budget and Policy Priorities compares the distributional effects of a trillion-dollar EITC expansion versus the tax bill recently signed by President Trump.

Representative Ro Khanna has proposed a $1 trillion expansion to the EITC. The plan would give about 50 million households an average tax benefit of roughly $3,000 per year; Americans earning more than $100,000 would get no tax benefit. In the graph below, the nonpartisan Center for Budget and Policy Priorities compares the distributional effects of a trillion-dollar EITC expansion versus the tax bill recently signed by President Trump.

The Trump Tax Cut vs. an Expansion of the Earned Income Tax Credit

Such an EITC expansion would raise by 5 percent the after-tax income of households making less than $30,000. That’s 10 times more than what those households would get under the new tax plan. People earning from $30,000 to $50,000 would also do better under this plan as well, though not as much as those earning less. This program’s impact on the national debt would be significantly less than the new tax policy.

Now, if you look closely at the above graph you will notice that people whose income is in the range of $50,000 to $100,000 don’t receive as much of a cut as they will get under the estimated Trump tax cuts. Arguably this group of people should be viewed as part of the middle class, especially if they are the major wage earner of a family who is also living in a region of the country where cost of living is above average. So, is there a way to make the tax code fairer for them, as well as for those earning less than $50,000.

What if the tax code was to actually raise the taxes of those who are making a hefty $200,000 a year by a modest 2 percent, and for those earning more than $400,000 a year by 4%? This additional revenue for the government would make it affordable to decrease the tax burden for those in the $50,000 to $100,000 range so it equals what they would get under the Trump tax cuts. With this tweak, the plan proposed by Representative Ro Khanna would be fairer to all families making less than $100,000 a year while eliminating any increase in the national debt. That would put distinctly more buying power into the economy, thus a benefit for all–poor, middle, and rich alike. Include into the plan a $15 an hour minimum wage law, and the economy would dramatically improve the bottom line for businesses across the country because it would stimulate an increase in spending.

Despite the merits of a plan that would expand EITC, increase the minimum wage to $15 an hour, and make some additional tweaks for those earning from $50,000 to $100,000 a year some argue that increasing taxes for the rich while reducing taxes for the working non-rich would be unfair? To understand why actually it is very fair, we first have to understand the nature of “capital.”

The Nature of “Capital”

There are a few definitions of capital. Here, whenever I use the word, I am referring to property such as money, land, housing, and tools that people own that they do not require for their basic needs such as food, shelter, healthcare, and transportation to and from work. In our society this type of capital can be uniquely used to earn more capital without the necessity to do any labor. Rather than labor, capital earns more capital via rental properties and interests from other investments. The way our society is structured, it is only the rich that have a significant amount of capital.

There are a few definitions of capital. Here, whenever I use the word, I am referring to property such as money, land, housing, and tools that people own that they do not require for their basic needs such as food, shelter, healthcare, and transportation to and from work. In our society this type of capital can be uniquely used to earn more capital without the necessity to do any labor. Rather than labor, capital earns more capital via rental properties and interests from other investments. The way our society is structured, it is only the rich that have a significant amount of capital.

Those who are in a significant portion of the middle class actually have to supplement their labor earnings by taking out loans to pay for their homes, cars, and post high school education. The interest that they pay on these loans go to financial institutions that the rich benefit by having investments in them.

Those who are in a significant portion of the middle class actually have to supplement their labor earnings by taking out loans to pay for their homes, cars, and post high school education. The interest that they pay on these loans go to financial institutions that the rich benefit by having investments in them.

Those who are in another significant segment of the middle class don’t have to take loans to pay for basic needs; their earnings from their labor just manage to cover those expenses. However, those in this segment have no money left over that can be considered capital.

Finally, those in another significant segment of the middle class find that after their earnings from their labor manages to pay for all of their basic needs, they do have a little money left over to save for their retirement, if they get injured, sick, or lose their job. What savings that they manage to put aside often increase from interest. Since this money is targeted for use to pay for basic needs in the future, it is not quite the same thing as the capital that the rich have.

In contrast to the middle class, the rich uniquely typically earn yearly, without the need to do any labor, more money from their capital than middle class people earn yearly through their labor. In fact, many rich folks earn yearly from their capital more money than middle class folks earn their entire lifetime.

Now, this difference between the type of earnings rich people have and middle class people don’t have is not something that we normally see in nature. Even a lion, said to be king of the forest, must labor to earn his basic needs. Thus, he has to exert himself to get food, and when he finishes eating the food that he labored to obtain, must then go out and exert himself to get more food.

The phenomenon of capital eliminates the requirement for rich people to labor in order to earn their basic needs. In fact, without labor, their capital most often keeps increasing, which is referred to as capital gains. So, even when the rich pay higher taxes then the middle class, they tend to live far more lavishly, only work if and when they want, and their capital continues to increase at no pains taken by them.

The phenomenon of capital eliminates the requirement for rich people to labor in order to earn their basic needs. In fact, without labor, their capital most often keeps increasing, which is referred to as capital gains. So, even when the rich pay higher taxes then the middle class, they tend to live far more lavishly, only work if and when they want, and their capital continues to increase at no pains taken by them.

So, for those middle class folks who support the new US tax policy, I suggest that they take a good look at the YouTube video of the capuchin monkey who is throwing cucumber slices at the experimenter. Perhaps these middle class people can learn from the monkey a basic principle of fairness and equity.

So, for those middle class folks who support the new US tax policy, I suggest that they take a good look at the YouTube video of the capuchin monkey who is throwing cucumber slices at the experimenter. Perhaps these middle class people can learn from the monkey a basic principle of fairness and equity.

———————————

Some people will enjoy reading this blog by beginning with the first post and then moving forward to the next more recent one; then to the next one; and so on. This permits readers to catch up on some ideas that were presented earlier and to move through all of the ideas in a systematic fashion to develop their emotional intelligence. To begin at the very first post you can click HERE.

Jeffrey,

I received your link through Division 46 and I think the article is great, in so many ways! Thanks for putting this out there for people to see.

Nancy Mramor, Ph.D.

Div 46 Media Div. APA

Much thanks, Nancy, for your kind words of support. Very much appreciated.

Jeff

Land is not capital. However many capitalists think it is and they, as landlords, still behave as if they were capitalists. The trouble with the land (as Will Rodgers pointed out) is that they ain’t making it any more. This means that it can become scarce, particularly in a development region where all the landlords, supported by their banks, own and withhold the rights for access to this natural resource. Naturally the scarcity makes it more expensive to purchase land or to rent some for use in productive and or residential activities.

So whilst the landlords speculate in land values and get wealthy by doing nothing except reducing the opportunities, the home-makers who need both land for a home and for entrepreneurs to provide employment, soon find the cost of a less costly house and the distance of it from a decent workplace, to be so significant that they enter the in-debt class of middle class. They become so busy earning enough to pay off their mortgages and in driving in over-crowded and polluted free-ways to their badly paid jobs that their lives become intolerable. They are poor in spirit if not in pocket.

When the landlords realize that what they are doing is morally wrong they usually turn a blind eye, so the best way to influence them and reduce the cost of useful sites of land is to ensure that these natural resources are put to use and this may be achieved by taxing land values instead of the many other limitations that our present tax regime applies to the production and consumption processes of macroeconomics.

TAX LAND NOT LABOR; TAX TAKINGS NOT MAKINGS!

Hi David Harold Chester,

Much thanks for your thoughtful comment. I have a great deal of sympathy for your position. There seems to be something fundamentally wrong with how land is handled economically in our society. In pointing out the difference between land and other things, you have sparked some thinking within me about how to clearly and precisely fairly deal with this. In New York City, where I grew up, there were some recognition of the points you made and efforts to deal with it involved “Rent Control Buildings” and there was a Michell-Lama program (see http://www1.nyc.gov/site/hpd/renters/mitchell-lama-rentals.page). I hope to delve into these efforts and try to come up with something that makes a better sense of all of this before too long.